Because managers cannot have complete information of performance, good management involves aligning the interests of the employee with their performance, through potential shares, bonuses, and promotions.

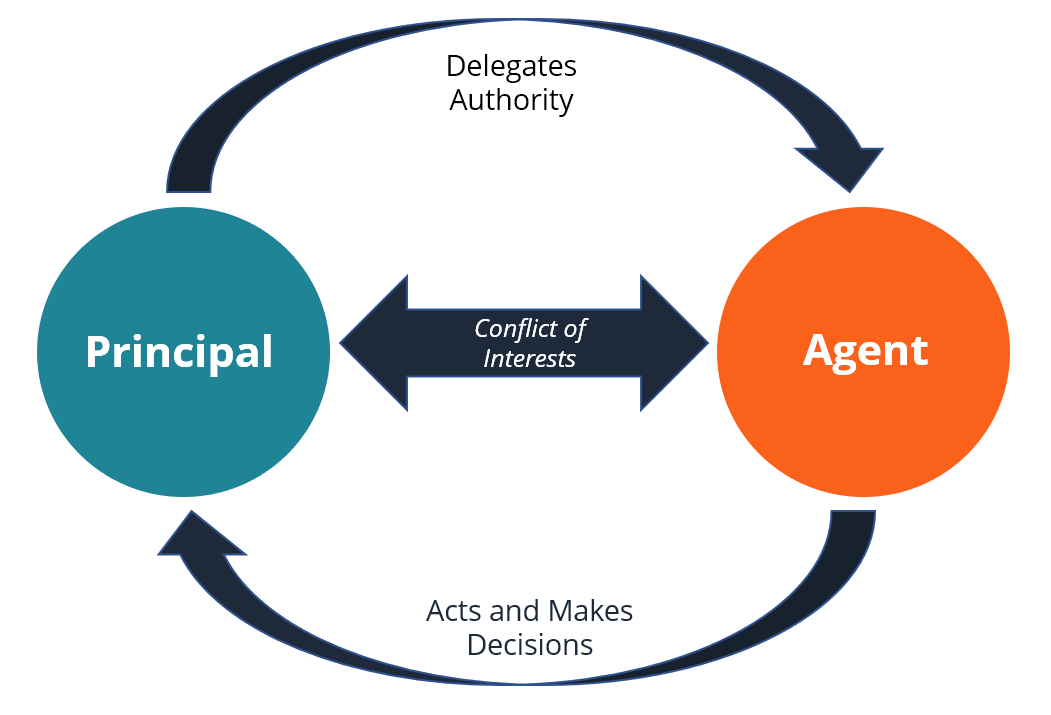

If you look a little closer you’ll see that principal-agent problems crop up a lot when one person employs another.

#INSURANCE PRINCIPAL DEFINITION FULL#

This happens if those that take the risks come to believe that they will not have to carry the full burden of potential losses.

When governments, central banks or other institutions decide to bail out lending institutions, this can encourage risky lending in the future. There’s also adverse selection in who takes up the insurance in the first place - those more likely to need the insurance (who are already sick) are more likely to take it up. You take out health insurance, and because someone else is responsible if you’re injured, you decide to pick up BASE jumping. In economics, moral hazard occurs when one person takes more risks because someone else bears the cost of those risks. All they need is a small personal stake in the outcome, and asymmetric information (where the agent has more knowledge than the principal), and you’ve got yourself a good old fashioned rodeo principal-agent problem.

For example, think of your lawyer (the agent) recommending that you start what will likely be a protracted and expensive proceeding you can’t be sure whether they’re recommending it because it’s in your best interests, their best interests, or both. Principal–agent problems occur when I (the "agent") make decisions on behalf of, or that impact, you (the "principal"). What are principal-agent problems? Definition and explanation

0 kommentar(er)

0 kommentar(er)